Guiding in Boulder

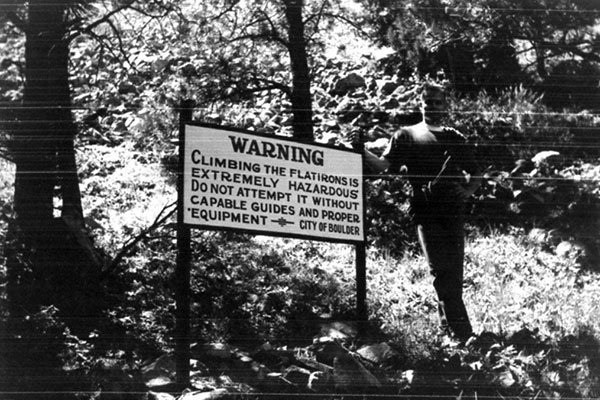

This warning to tourists on the Mesa Trail was good advice back in the 1950s – it’s still true today.

Mountain Guides are best in their own terrain. Experienced Guides can and do take their clients around the world to climb and ski but landing up high in unfamiliar surroundings and expecting to guide clients safely is a tall order, even for IFMGA Guides.

Most Guides prefer to take clients to their home terrain on routes they’ve done for years. Ski Guides who have seen their snowpack develop each season over decades have an uncanny eye for safety and quality. The best Ski Guides are locals and can serve up soft powder turns under almost any conditions.

Likewise, local Rock Guides have their terrain thoroughly sussed, with the belay stances, gear choices, and sun angle on their trade routes optimized for client experience. Local Guides also have access to the best resources for their clients to enjoy and are happy to make a lunch reservation at the classic Hut or a spa appointment for the down day. There is simply no substitute for this level of knowledge and experience, and clients that hire local Guides for their adventures can have high confidence in a successful outcome.

The same is true for Venture Capitalists. It takes years of investing in dozens of startups across multiple market cycles to find out if you’re any good at this business. Local knowledge comes dear and the original mistakes we make along the way add to our confidence in our thesis and our value to entrepreneurs.

Cheap money and bull markets make everyone look like an expert, especially the noobs who trumpet their illiquid successes as if they matter. They don’t – what matters is the ratio of Distributed to Paid in Capital (DPI), the only long-term measure of a fund’s success.

Experienced VCs become determined sellers and cautious buyers in these environments, aggressively returning capital to their investors in advance of the inevitable reckoning. When the market avalanche comes roaring at them, the best VCs are ready with fresh capital to invest in the best serial entrepreneurs in the best local companies at reasonable prices.

My partners and I closed Boulder Ventures VIII on November 21, 2022 at $58 million. We are ready to guide the next cycle.

Their BV8 fund raising efforts behind them, the BV GPs pause their fall offsite planning for a Flagstaff tower-claiming session, October, 2022.